Paying for Long Term Care

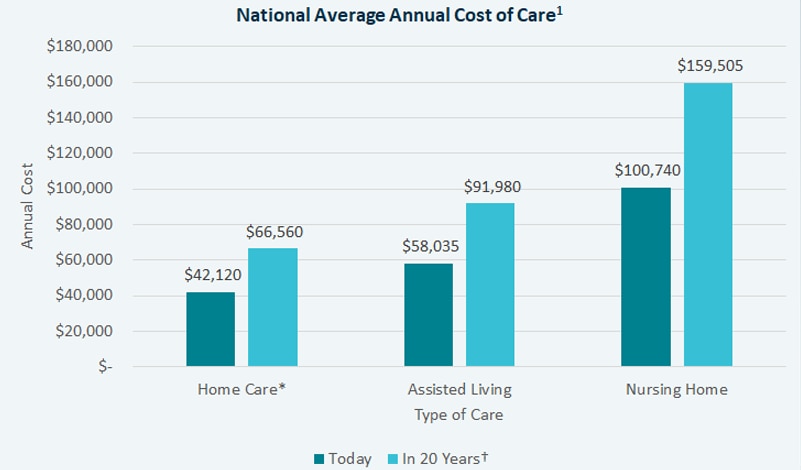

There are a variety of care options available should you ever need long term care, but the costs of these services can be expensive and vary greatly depending on the type of care you receive, the place it's provided, and where you live. Due to inflation, the cost of care is also expected to only increase over time.

Use our Cost of Care Tool to find the average cost of care in your area.

Your Options

Long term care is not typically covered by health or other types of insurance. It is often provided at home by unpaid caregivers such as adult children and other family members.2 When it comes to paying for long term care, there are a few different options.

Self-funding

This can include using your or your family's personal resources, including savings and investments, or other assets such as your home to pay for long term care. Learn more about self-funding.

What programs don't pay

Health insurance plans like the Federal Employees Health Benefits (FEHB) Program, TRICARE, and TRICARE For Life and disability income insurance typically don't cover long term care.

Medicare may cover some care in a nursing home and at home, but only for a short period of time and subject to restrictions.

What programs may pay — with limitations

The U.S. Department of Veterans Affairs makes certain long term care services available to veterans, based on a priority ranking system. Learn more at va.gov.

Medicaid covers long term care but only if you spend down your assets to state-required levels and receive care that meets your state's guidelines. Contact your state Medicaid office for more details.

Long term care insurance

Long term care insurance (LTCI) is designed specifically to pay for covered long term care services in many settings, both at home and in a facility. It can help ensure your independence and reduce your reliance on loved ones if you need care. It can also help protect your savings and assets from being depleted by long term care costs when you use LTCI benefits for covered services.